The Ultimate Guide To Tulsa Debt Relief Attorney

The Single Strategy To Use For Bankruptcy Attorney Tulsa

Table of ContentsTop Tulsa Bankruptcy Lawyers Can Be Fun For AnyoneSome Known Factual Statements About Chapter 13 Bankruptcy Lawyer Tulsa The Definitive Guide to Which Type Of Bankruptcy Should You FileThe 30-Second Trick For Tulsa Bankruptcy Legal Services3 Simple Techniques For Tulsa Bankruptcy LawyerThe Single Strategy To Use For Chapter 13 Bankruptcy Lawyer Tulsa

Individuals need to utilize Phase 11 when their financial debts exceed Phase 13 financial obligation limitations. Tulsa bankruptcy lawyer. Phase 12 insolvency is made for farmers and anglers. Phase 12 repayment plans can be much more flexible in Chapter 13.The means examination takes a look at your typical monthly revenue for the six months preceding your filing day and contrasts it versus the average revenue for a similar household in your state. If your revenue is below the state average, you automatically pass and do not have to finish the whole form.

If you are married, you can submit for personal bankruptcy jointly with your spouse or independently.

Declaring insolvency can assist an individual by disposing of financial obligation or making a plan to settle financial obligations. A personal bankruptcy instance generally starts when the debtor files a request with the insolvency court. There are different types of bankruptcies, which are normally referred to by their phase in the United state Bankruptcy Code.

If you are facing economic difficulties in your personal life or in your company, chances are the idea of declaring insolvency has crossed your mind. If it has, it likewise makes sense that you have a great deal of insolvency questions that require responses. Lots of people in fact can not respond to the concern "what is bankruptcy" in anything except general terms.

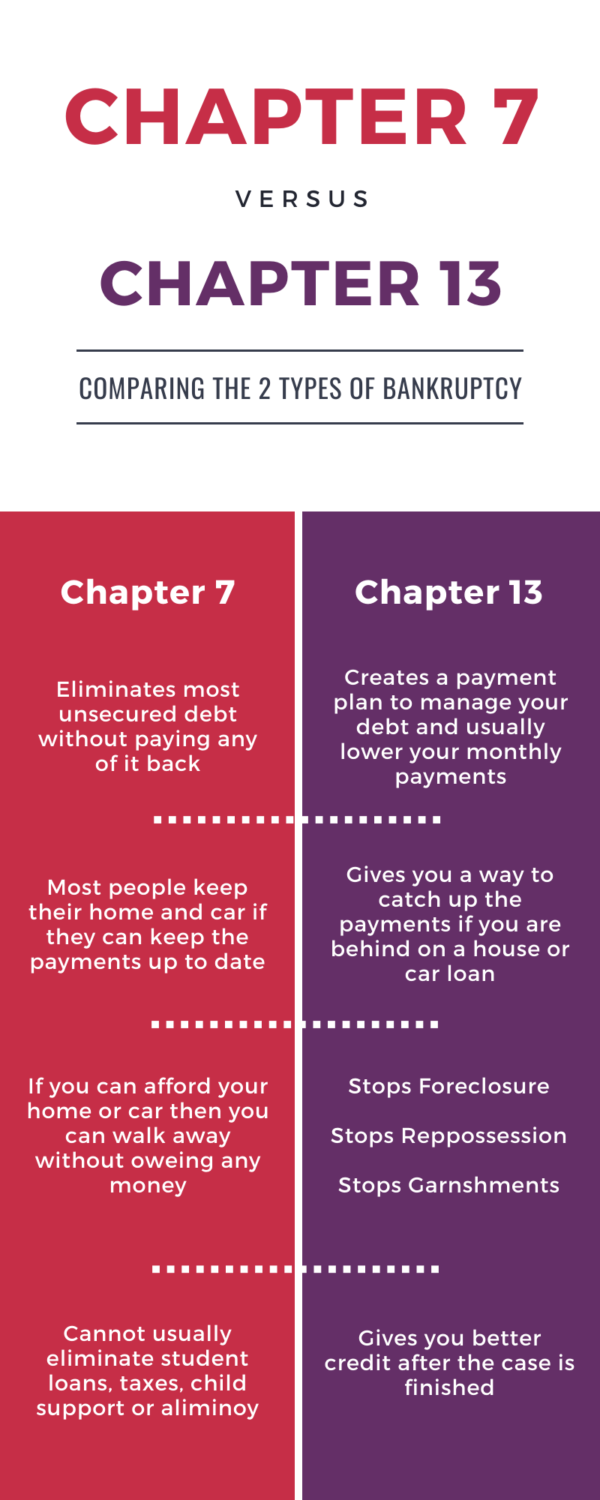

If you are facing economic difficulties in your personal life or in your company, chances are the idea of declaring insolvency has crossed your mind. If it has, it likewise makes sense that you have a great deal of insolvency questions that require responses. Lots of people in fact can not respond to the concern "what is bankruptcy" in anything except general terms.Many individuals do not recognize that there are numerous kinds of personal bankruptcy, such as Chapter 7, Phase 11 and Chapter 13. Each has its advantages and obstacles, so knowing which is the most effective option for your existing circumstance as well as your future healing can make all the difference in your life.

Getting My Chapter 7 Vs Chapter 13 Bankruptcy To Work

Phase 7 is labelled the liquidation personal bankruptcy chapter. In a chapter 7 bankruptcy you can get rid of, eliminate or release most kinds of financial obligation. Examples of unsafe financial obligation that can be cleaned out are bank card and medical costs. All kinds of individuals and business-- individuals, married pairs, corporations and collaborations can all submit a Phase 7 insolvency if eligible.

Several Chapter 7 filers do not have a lot in the way of properties. Others have homes that do not have much equity or are in severe demand of repair service.

The amount paid and the duration of the plan relies on the debtor's property, average income and costs. Financial institutions are not enabled to seek or maintain any collection activities or suits throughout the situation. If effective, these financial institutions will certainly be eliminated or released. A Chapter 13 bankruptcy is extremely powerful since it provides a device for debtors to avoid foreclosures and sheriff sales and quit repossessions and energy shutoffs while catching up on their secured debt.

Bankruptcy Lawyer Tulsa Can Be Fun For Anyone

A Phase 13 case might be beneficial because the borrower is enabled to obtain captured up on home mortgages or auto loan without the risk of foreclosure or foreclosure and is allowed to maintain both excluded and nonexempt building. The borrower's strategy is a record outlining to the insolvency court exactly how the debtor recommends to pay present expenses while settling all the old financial debt balances.

It gives the debtor the chance to either market the home or become caught up on mortgage repayments that have fallen back. A person filing a Phase 13 can suggest a 60-month strategy to heal or end up being existing on home mortgage payments. For instance, if you fell back on $60,000 well worth of home mortgage payments, you could propose a strategy of $1,000 a month for 60 months to bring those home loan settlements existing.

It gives the debtor the chance to either market the home or become caught up on mortgage repayments that have fallen back. A person filing a Phase 13 can suggest a 60-month strategy to heal or end up being existing on home mortgage payments. For instance, if you fell back on $60,000 well worth of home mortgage payments, you could propose a strategy of $1,000 a month for 60 months to bring those home loan settlements existing.7 Easy Facts About Tulsa Ok Bankruptcy Attorney Explained

Sometimes it is bankruptcy attorney Tulsa far better to stay clear of personal bankruptcy and work out with financial institutions out of court. New Jersey additionally has an alternate to bankruptcy for businesses called an Project for the Advantage of Creditors and our law practice will certainly discuss this choice if it fits as a prospective method for your service.

We have actually created a device that aids you choose what chapter your data is probably to be filed under. Go here to make use of ScuraSmart and figure out a feasible solution for your financial obligation. you can check here Many individuals do not realize that there are numerous sorts of bankruptcy, such as Phase 7, Phase 11 and Phase 13.

Below at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we manage all kinds of insolvency cases, so we have the ability to address your personal bankruptcy questions and aid you make the finest decision for your instance. Right here is a quick appearance at the financial obligation alleviation options readily available:.

Fascination About Tulsa Debt Relief Attorney

You can just apply for insolvency Prior to filing for Phase 7, at the very least one of these should be true: You have a great deal of financial obligation revenue and/or assets a lender can take. You shed your motorist certificate after being in a crash while uninsured. You require your permit back (Tulsa bankruptcy attorney). You have a great deal of debt close to the homestead exemption amount of in your home.

The homestead exemption quantity is the better of (a) $125,000; or (b) the area average list price of a single-family home in the preceding fiscal year. is the quantity of cash you would maintain after you offered your home and settled the home loan and other liens. You can find the.